This Article was originally published in The Global Analyst

“While markets and fundamentals seldom do a tango, a disconnect between the two carry the risks of disruptive market corrections.” RBI

Covid-19 is now being talked about in relation to WWII type of an impact. It has destroyed economies, disrupted supply chains, and resulted in huge job losses with no vicinity of a solution. Yet, the stock market has impressively bounced back from its March lows and is heading higher by the day, both globally and in India. Are we missing something here?

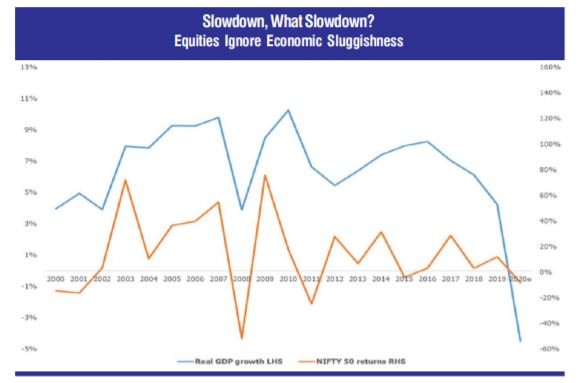

While stock market and broader economy do not enjoy a 100% correlation, they do rhyme as we can see from the graph. The connect is very clear and palpable during 2008 Global Financial Crisis. However, we see no such connect now which is what this article is trying to explore.

Let us first see the market bounce back. The year 2020 has a roller coaster pattern for the broader market with Nifty hitting a peak value of 12,362 on 14th January and hitting a bottom of 7,610 on March 23rd only to recover back to 11,500 levels presently. In other words, the market fell in the first place due to covid fears by 38% and subsequently staged a V-shaped recovery of nearly 50% with an YTD loss of a modest 7%. What caught people by surprise is the speed and scale of recovery completely ignoring the bad economic scenario. The exceptional market recovery is happening on the back of subdued volatility as measured by the Indian volatility index which briefly peaked at 83 during March before dropping back to its long term average of about 20.

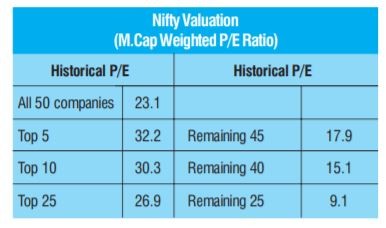

The sharp recovery of the Indian equity market has also lead to steep increase in its valuation where the price to earnings ratio reached a staggering 23, 2 standard deviation above its 10 year average. It is indeed surprising to see a warning coming from the RBI about the market stretch, not once but twice!

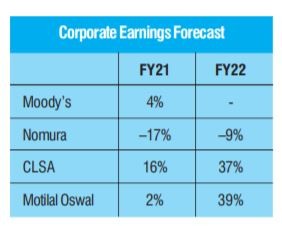

While the markets are enjoying a great rally from its March bottom, let us see how the economy is poised due to covid. First, the big picture in terms of GDP. The real GDP for India has never been negative in the recent memory and we will have a negative real GDP growth of 4.5% according to IMF during 2020. An emerging market like India with huge job creation needs, requires a real GDP growth of at least 6 to 7%. The covid healthcare impact still playing out. The visibility on the covid front is rather poor and covid statistics for India is turning from bad to ugly in the last few months. India now is just a shade behind US in terms of number of cases and can shortly have the ubiquitous position of being no.1 in covid cases in the world. While the mortality rate is low, the burgeoning number of cases is rather a huge worry. This has affected our exports, increased unemployment and dented credit growth leading to increasing bad loans. A look at Purchasers Manufacturing Index clearly reveals the pain. The immediate casualty of this economic mayhem is the corporate earnings which forms a great basis for equity pricing. There is a distinct lack of clarity when it comes to estimating earnings for FY21 by brokers though it gets better for FY22. For e.g., Nomura predicts a 17% fall in earnings in FY21 while CLSA predicts a 16% increase.

There are many ways to understand or justify this disconnect between market and economy. While the general argument that market is always forward looking and hence we can infer that the broader market is pricing a V-shaped economic recovery generally holds true, there are many other factors at play. I will explore some reasons briefly.

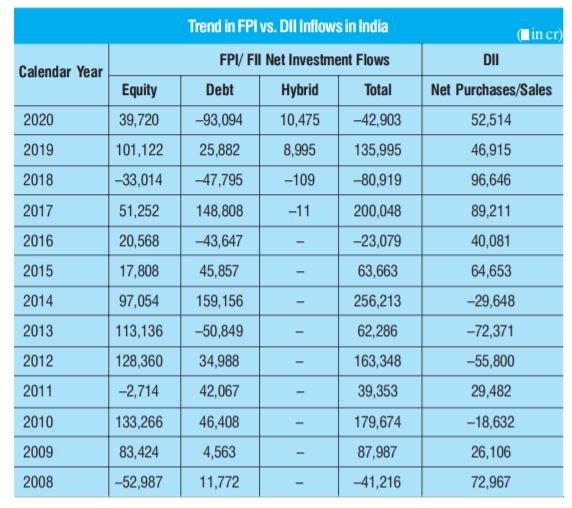

1. Copious Liquidity: The Fed and other central banks (including India) has opened the liquidity tap as a response to Covid destruction. This has resulted in strong capital flows both from foreign institutions and domestic institutions. Foreign Institutional Investors (FII’s) has been consistently investing in India as can be seen from the table. Barring few years like 2008, 2011 and 2018, FII’s have been investing consistently both in debt and equity segments. However, during the current year FII’s have divested heavily from the debt segment (due to falling yields).

2. Government Stimulus: Government across the globe responded through fiscal and monetary measures in order to rev up the economy and help various sectors face the covid heat. This has ranged from 10% of GDP to more than 50% of GDP for many countries and India is no exception. Such direct government intervention creates huge positive impact on market sentiment though the stimulus program may take time to work through the system.

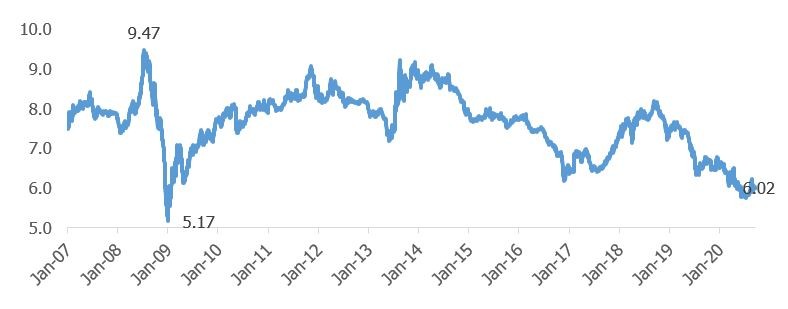

3. Lower Cost of Capital: With demand falling and supply chains disrupted, RBI has been pursuing a loose money policy resulting in steep reduction in bond yields and therefore cost of capital. The 10-year sovereign bond yields are approaching historical low experienced during the GFC days. Yields have fallen from a recent high of about 8% seen during October 2018 to about 6% now. A falling yield will also imply higher valuation! Also, there is a strong market expectation of yields falling even further in case economic revival hits road blocks and inflation is manageable.

4. Return of Retail Investors: The strong market rally is also attributed to the return of retail investors to the market as they enjoy some free time due to lockdown and work from home aspect. This has encouraged many to plunge into day trading to earn some quick money. Data from NSDL and CSDL indicate that nearly 57 lakh new retail trading accounts have been added during the period January to August 2020. However, a direct attribution of this to market rally can be dangerous.

5. This rally is Bi-Polar: While we always see the broader index like Nifty and Sensex, there is huge polarity in these indices with few stocks tilting the balance in its favor. For eg., while the overall p/e for the market is 23, the top 5 p/e is about 32 while the remaining p/e for the 45 companies in the Nifty 50 is only 18!. In other words, the broader market

is still cheap!

6. Market is never the economy in the first place: It will be a mistake to assume that stock market represents the broader economy. Far from it, since stock market (especially the broader index like Nifty or Sensex) only represents large companies from the organized sector. On the other hand, the economy comprises both the organized and the huge informal segment that is more easily disrupted by economic downturns. In addition, many of the Sensex or Nifty companies do not depend entirely on the home market for their revenues and profits especially information technology stocks. Due to these reasons, there may not be and there should not be a direct correlation between markets and the economy.

While these arguments can look credible, we should tread some caution and expect market to adjust to economic reality. While the hope is for a sharp rebound in economic activity, it may not be easily forthcoming due to both demand and supply side pressures. While the market representation is not mimicked in the economic structure, it is inconceivable to think that economy will be in ruin while markets will celebrate. There need not be and may not be an immediate correlation but ultimately stock markets reflect economic realities. Loose monetary policy, low cost of capital and copious liquidity can keep the musical chair on, but there will come a time when the music has to stop. Added to this is the political uncertainly on the China border that sounds like getting worse. As an investment strategy, it is better to increase your cash and reduce your equity exposure till we see sure signs of economic recovery as studied from a clearer earnings picture. It is always prudent to be safe than sorry.

Happy Investing!