This Article was originally published in The Global Analyst

If there is one monumental reform that is yet to be exploited by investors, it is the RBI`s decision to permit Indian investors to invest up to $250,000 per annum in global markets (stocks, bonds, ETFs and also real estate) through its Liberalized Remittance Scheme (LRS). The response on the part of retail investors has not been encouraging so far, which could be either due to lack of awareness or fear of risk, or what some call, perception problem; although this may not be the case with High Net Worth Individuals (HNIs), yet they may find the limit of $250,000 too low! Nevertheless, the rise of digital banking and fintechs means investors may no longer have to visit a bank branch to pay a foreign broker (tech-savvy banks such as ICICI Bank allow a completely online process for transfers up to $25,000 10% of the total LRS limit, according to Mint), and this should encourage more investors to think of parking a part of their investments in foreign equities.

However, if you have not yet decided, I would enumerate three reasons why investing in global markets makes sense, which would help you understand the risk-return trade-off well and take a call.

1. Broader opportunity set: Though Indian stock market takes pride in having the largest number of listed stocks anywhere in the world, from a practical point of view, the opportunity set is restricted to a maximum of Nifty 500. In fact, realistically, most of the funds are benchmarked to Nifty 50 or Sensex (30 stocks) limiting the universe even further. In addition, these benchmarks are dominated by financial stocks and consumer discretionary sectors. In contrast, global markets, including the US, are moving in favor of technology, which has experienced multi-decade expansion and is less correlated with cyclicals. Hence, exposure to international stocks can allow Indian investors to benefit from the strong momentum currently seen in technology sector stocks as well as their future growth potential. We are all aware of the huge role Amazon, Netflix, Google, Facebook, and Microsoft play in our everyday lives in India. However, these companies are not listed in India.

2. Better portfolio impact: In spite of the exemplary performance of Indian stock market post budget, the long-term performance of Indian stocks lags behind that of their global peers across all periods. In addition to low performance, Indian market exhibited higher risk (volatility), reflected in higher standard deviation. In other words, Indian market provided lower return for higher risk, while global markets provided higher returns for lower risk. Hence, investing in foreign stocks presents a great case for diversification. In addition, the correlation between Indian market and global markets is not very high, making the portfolio impact much better. A word of caution though: higher historical returns can also imply lower prospective returns (due to mean reversion) and vice versa. In other words, given the longer than 10-year bull run in S&P 500, foreign stocks (essentially, US equities) may provide lower returns, while Indian equities could outperform. This view again supports the need to diversify which will help the portfolio to be more stable.

3. Ease of investing: Technology has now enabled investing to be less costly and speedier. Several platforms are available for Indian investors to directly invest in foreign markets. Some examples include Stockal, Vested finance, Winvestra, Kuvera, Axis Securities, ICICI Securities, HDFC Securities, Upstox, etc. The process of opening and operating an account is rather seamless, thanks to the technology.

The abovementioned three reasons clearly demonstrate the case for investing some part of your wealth in foreign stocks. However, investors should note the following:

· There are two ways to invest in foreign stocks. One can take the mutual fund route or the direct investing route. In India, currently there are more than 40 mutual funds that exclusively invest in foreign stocks, mostly the US. These are mostly structured as fund of funds. Remember, the limit of $250,000 do not apply if investors invest via this route. However, since they are structured as fund of funds, they can be expensive. The other option is to invest directly by opening an account with one of the platforms cited before. This will enable investors to directly buy individual stocks. However, I would not recommend this option for many reasons. Recent happenings in the US where group of investors formed a cartel like approach to take penny, non-performing companies to dizzying heights should act as a warning for investors. Unprecedented rally in GameStop, Dogecoin, Bitcoin, etc. have raised concerns of foul play by vested interests (read: speculators). The saga of GameStop, a gaming company that is loss-making where its share price zoomed from $19 to $400 only to drop to $50 all within a few weeks, can be an important lesson for investors. Those who follow social media influencers` advice and stock tips can get easily lured into this “easy money” syndrome and can lose their shirt! Hence, it is advisable to invest only in index via the ETF route if one is operating in the direct mode.

· Investors should be aware of two distinct but important variables when investing abroad. The first is the currency risk. The Indian rupee has been performing very well against USD in the recent past, posing not much of a currency risk to foreign investors. However, that may not be the case going forward as emerging markets always face huge currency risk and India cannot be an exception. Hence, investing in dollars (that is, investment in equities) can have dual source of risk, one of which can be the currency risk, while the other is the market risk. In addition, the tax aspects can be a bit complicated. For example, short-term capital gain is taxed at slab rate, while long-term capital gains is taxed at 20%. The holding period assumption for long-term is always higher at two years. In other words, a capital gain qualifies as long-term only if it is held for more than two years. On top of this, dividends are also taxed, though this can be offset due to double taxation treaties between India and the US. However, tax part will need consultation from experts.

· Direct investing will need an investor to open an account with a technology platform, and this will need some sort of due diligence as it involves a variety of costs like demat, broking and currency conversion. In addition, the robustness of functionalities offered by the platform is also important. All this will require careful due diligence before opening the account.

Portfolio Strategy

Having established the case for investing in foreign stocks, the key question is how much (portfolio allocation) that should be? I have tested some combinations and the results are presented here

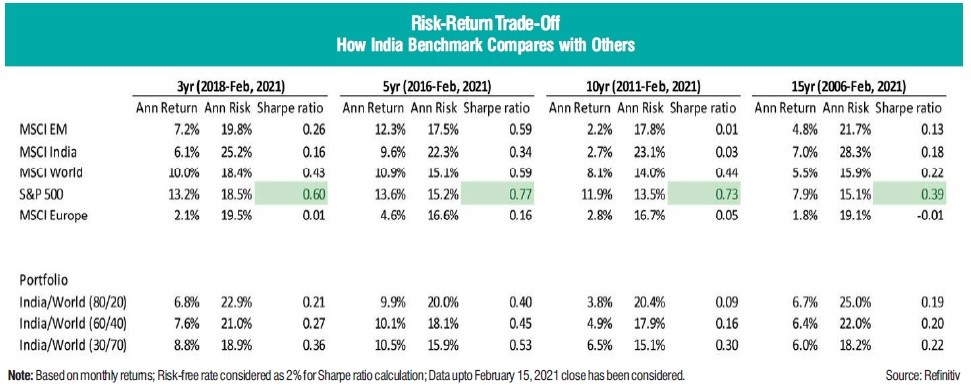

The performance of MSCI India (I chose this as it is designated in USD and hence becomes comparable with other global indices) is compared with other indices.

We can see that Indian market performance is mostly on a par with MSCI Emerging Markets, but it significantly lags behind MSCI world, S&P 500 and MSCI Europe. In addition, the risk for the Indian market (as measured by standard deviation) is higher, leading to lower Sharpe ratio. Given a correlation of about 0.65 with S&P 500 and MSCI Europe, a portfolio comprising a combination of India with MSCI World can definitely lead to superior results.

We have tested three such combinations ranging from a 20% global share to 70% global share and found that in each of the time periods (3, 5, 10 and 15 years historically) the higher share of global

stocks improves portfolio performance significantly. While a 70% share of global stocks in an Indian investor portfolio can be mentally unsettling, this study goes to confirm the importance of having foreign stocks in one’s portfolio.

Mutual funds sahi hai!

To conclude, investing in foreign markets, especially the US, is a welcome thing for investors as it offers good potential for diversifying one’s portfolio and hence helps in risk reduction. It opens up more opportunities and enables Indian investors to participate in the rally in global technology stocks that are not listed in India.

However, a word of caution: one must tread with caution before taking exposure to overseas equities. It is strongly advised that a retail investor should invest only via index funds or ETFs to begin with and should avoid taking direct exposure to equities. Nevertheless, it is also advisable to seek one’s financial advisor’s views before making investment-related decision.