This Article was originally published in The Global Analyst

“It’s far better to buy a wonderful company at a fair price than to buy a fair company at a wonderful price” Warren Buffet

There is something very nice about the term “Value Investing”. It signifies value and in the investment world, if one is not chasing value, what else to chase for? When I look back and see the list of value investors in the world, they have some great names like Benjamin Graham, Warrant Buffet, Charlie Munger, Seth Klarman, Peter Lynch, Walter Schloss, Mohnish Pabrai, etc. Of course, this list can be extended to include other names. However, they are far and few. The reason being, value investing is easy to understand but hard to practice.

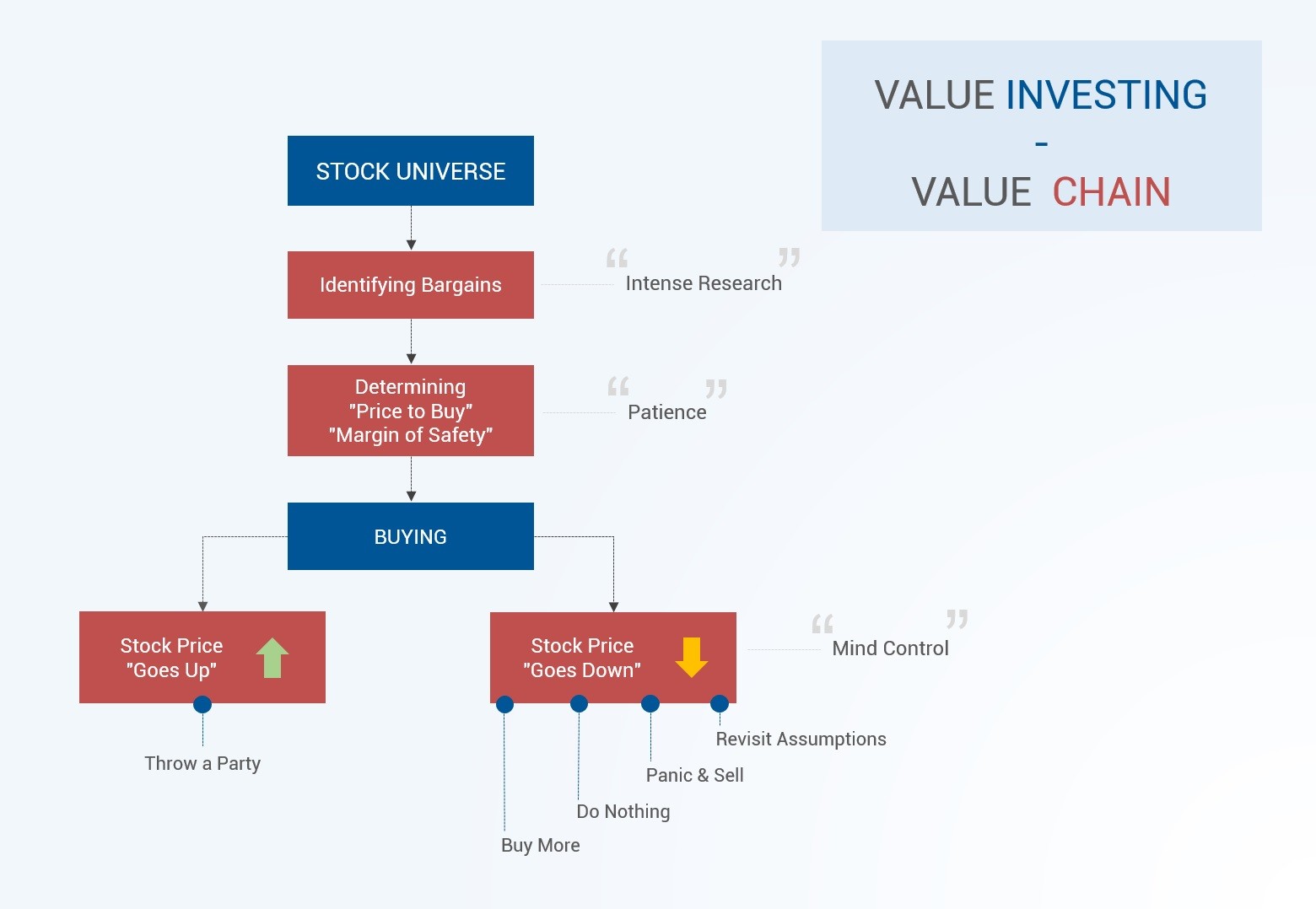

Firstly, what is value investing? Very simply, it is buying great companies at a cheap price. The value chain of value investing involves a series of interesting steps. From the large stock universe (In India, this can mean more than 8,000 stocks) one has to sift through this universe to identify “bargains” based on intense research. Once we identify the bargains, we should establish a price point at which we should buy the stock. This will involve estimating the intrinsic value of a company, expected price in the future (what is normally referred to as target price) and waiting for a price that should provide us with significant margin of safety. Seth Klarman takes the credit of introducing this term “margin of safety” to the investment world . Once, such a price point is reached, we jump in and buy. Therefore, we have two problems. We need to spot great companies and we should wait for the price of those great companies available at a very reasonable price. There is a counter intuitive logic here. Why should market misprice great companies or why should great companies be available at a cheap price? This is where it becomes hard to practice.

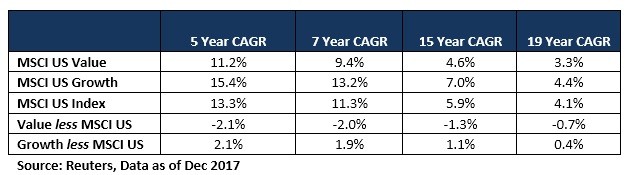

Analysts love price to earnings ratio (p/e) and one can see its almost daily use in the financial markets. Value investors focus on the “p” of the p/e ratio more than “e” of the ratio. Conversely, growth investors focus on the “e” and may be prepared to buy growth companies even at a higher price. Value investing tend to perform well during strong economic cycles while growth investing performs well during weak economic cycles. According to Fama and French, value stocks outperform growth stocks and hence there is value premium. However, this plays out only in the long run while in the short run, one can easily see evidence of growth stocks out performing value stocks. Here is the data pertaining to US stock markets.

There are three reasons why it is hard to practice:

1. Intense Research: To identify great companies among thousands of companies requires very high analytical skills and research skills. The analyst should develop a strong understanding of the underlying business, company’s competitive position, pricing power, balance sheet strength, etc in order to identify a needle in the haystack of stocks. The research will also involve estimating future cash flows and therefore expected future price. Such estimations require thorough market probe, interaction with company management, sifting through reams of documents (especially the small prints) and making assumptions. As one can understand, the process is intense and requires technical skills. Unless, one takes up this activity as a full time activity, it will not yield results.

2. Mind Control: The idea behind value investing is to buy great companies at bargain prices. Generally, great companies are rarely available at bargain prices. Bargain prices are available only during market meltdowns when investor sentiment is negative all around. To be having the guts to swim against the tide, identify the bargain, and buy companies requires enormous mind control. The story does not end here. It is highly likely that the price of the stock, post purchase can go down further. It is at this stage the role of mind control plays even more important role. Once the price goes down, it opens up several confusing thought trails. Should we buy more, should we panic and sell, should we do nothing, should we revisit our assumptions, etc.

3. Patience: Value investing is more like Sunday fishing and is certainly not formula one driving. Just as how boring Sunday fishing can be, value investing also requires enormous patience. After identifying a great company, one has to wait for it to reach the “desired” price at which it will provide significant “margin of safety”. That price can be obtained in the short-term or medium term or even long term. The trick is not to get bored and buy the stock at the current available price. Patience is truly a virtue here.

Great value investors adeptly combine the three factors enumerated above with great zeal. Warrant Buffet and Charlie Munger, even at this age, spends a lot of time reading (factor 1). When global financial crisis hit in 2008, they had the mind control to jump in and buy great companies at reasonable price (factor 2) when the whole word was falling around. All through their long career, they have been helped by patiently waiting for opportunity to throw up (factor 3). A reading of their various annual letters to shareholders will show how they cleverly combined the three factors to become one of the richest person on earth.

Happy Investing!