Why sector calls make more sense in Indian Equity

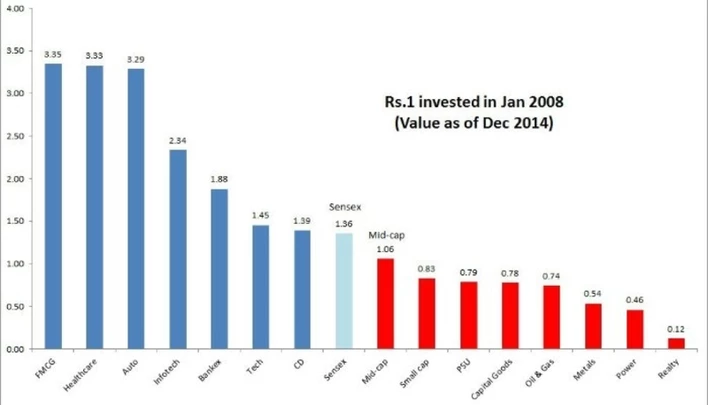

The numbers speak for themselves. During the last six years, if you had invested Rs.1 in FMCG sector, it is worth now Rs.3.35 as against Rs. 1.36 for Sensex and 12 paise for Realty sector. In annualized terms, the FMCG produced an annualized return of 18.8%, Sensex 4.-4% p.a while the Realty sector produced an annualized return of -26% p.a. During the last six years, FMCG, Healthcare, Auto, Information Technology and Banks produced good returns compared to Realty, Power, Metals, Oil & Gas and capital goods. Isn’t it time to differentiate among sectors?

Even sophisticated investors do not consider sector bets as seriously as it deserves. While the broad market is comprised of many sectors whose performance ranges define the average performance of the index, investment performance can be enhanced significantly by choosing good sectors and avoiding bad sectors.

While the overall market is represented by Sensex which is a confluence of all the sectors, the performance of Sensex will also be balanced by both well performing sectors and poorly performing sectors. Additionally, active fund managers also do not make serious deviations in favor of well performing sectors for the fear of tracking error.

The case of investing in a broad based index like Sensex will ensure the presence of both good and bad sectors thereby taking away the benefit of performance in the guise of offering diversification. If academic theory says that it is quite possible to have a fully diversified portfolio with just 10 stocks, then identifying those stocks among the well performing sectors should be the way to go. Hence, investing in broad based index fund or ETF may not be as much a good idea as investing in well performing sectors. Even among well performing sectors, as per traditional theory, the investing should be focused on the index heavyweights whose performance can significantly influence the overall performance of the sector index. For eg., in the case of FMCG, the performance of ITC, Hindustan Lever and Nestle should definitely matter as they have larger share in the index. However, if you look at the leaders and laggards, in most cases it has names not among the heavyweights. Hence, the job is not done by simply investing in sector funds. It is quite possible to improve the portfolio performance significantly by fishing within the sector basket which calls for stock picking. This argument is even more relevant if we consider the divergence in performance of leaders and laggards relative to the sector index performance. For eg., in the consumer durables segment the best performer has been TTK Prestige with an annualized return of 49% while the worst performance in the same sector has been Gitanjali Gems at -18% p.a. with the overall sector performance at 4.8% p.a. Very clearly, the individual stock performance diverges significantly from the mean providing immense opportunity for stock selection.

The good/bad paradox

While the general case is to embrace good performing sectors as against not so good performing sectors, as said before, there may also be cases of good stocks in bad sectors and bad stocks in good sectors. For eg., Sunteck (+14%p.a) in Realty sector (-26% p.a.) and IDBI (-8% p.a.) among Banks (+9.4% p.a). In case where such stocks are index movers, a closer scrutiny may be warranted. However, if they are not index movers, then it may not be worth our time to finely distinguish this aspect. More than selecting good companies in bad sectors, it may be worthwhile to avoid bad companies in good sectors and improve portfolio performance.

More dimensions to evaluate sector performance

Apart from the annualized performance of the sectors, there can be inspection of stocks within the sector in terms of outperforming the sector index as well outperforming the broad market index (Sensex). Companies that outperform both their sector index as well as the broad market index can obviously be classified as superb while at the other end of the spectrum we may have companies underperforming both their sector index as well as broad market index (called poor) and all others falling in between. For example, in the consumer durables sector where we have 10 companies, 7 of them out performed the consumer durable sector index as well as Sensex indicating a larger pool of opportunities to choose from. On the other hand, in the technology space where we have 24 companies, 12 companies underperformed both the Technology index as well as Sensex limiting the opportunity pool. In the overall analysis, out of nearly 200 stocks, 89 stocks outperformed both their respective indices as well as Sensex and they mostly belonged to good performing sectors.

What explains sector performance?

FMCG

Increasing disposable incomes, favourable demographics augur well for the resilient consumption theme. Rural India has been a big driver aided by National Rural Employment Guarantee Act (NREGA) payments.

Healthcare

Resilient to macro headwinds and favourable currency tail winds have benefitted the sector. Cheaper manufacturing costs by c.30-50%, abundant talent pool and regulatory expertise have helped in establishing a stronghold in generic space globally. Future driver: series of patent expiry in US.

Auto

Surging aspirations of middle-class, low per capita ownership of vehicles had led to strong 20%+ growth in 2010 & 2011. Headwinds in the form of higher interest rates and fuel prices have taken a toll on volume growth since then.

Consumer Durables

Higher inflation and rupee depreciation had led to constant price hikes, leading to deferment of purchase of items like appliances and other durables, which essentially are discretionary in nature. This is reflected in the Index of Industrial Production. Production in the Consumer Durable sector has consistently been in negative territory.

Banks

Economic slowdown which exposed inadequate appraisal and monitoring of credit proposals and a move to system-driven identification of NPAs had led to increase in gross NPA level for the banks. Implementation of Basel III norms by March 2018 would require significant capital and issuance of new bank licences is poised to increase the intensity of competition.

InfoTech

Spending on technology and related services has grown at a faster rate than the GDP growth. With organizations trying to reduce operational costs amidst competitive business environment, global sourcing has gained prominence benefitting the IT players. The currency depreciation is an icing in the cake!

Tech

Uncertain regulatory environment and outbreak of scams has marred the telecom sector. The ensuing recommendations by the regulator towards spectrum auctions, pricing and re-farming had fuelled the already existing uncertainty and were viewed negatively by the players. Retrospective tax imposed on Vodafone exposed the flip flop approach of Indian authorities to the world at large.

Metal

Capacities which were increased on expectations of higher demand resulted in oversupplied market leading to intense competition amongst domestic suppliers. Mining industry was gripped in a seemingly ceaseless national debate on issues related to illegal mining practices. Iron ore export slumped 69% in 2012-13 from a year ago.

PSU

The deterioration of bank asset quality is more pronounced in PSU banks. Higher crude imports and subsidized pricing of Diesel, LPG and Kerosene has resulted in c.16% increase in under recoveries for the Public Sector OMCs.

Oil & Gas

Weak macro environment and slower growth have led to volatile margin environment causing downward bias.

Cap Goods

Slump in investments across the sectors, particularly in infrastructure space (like power) due to policy uncertainties had led to poor order flow. Orders have become stagnant and competition has become intense as many players chase the few available orders.

Power

Issues of coal linkages, environmental clearances, land acquisition, fund constraints (sectorial exposure limits) and scarcity of skilled manpower have hindered new projects, while on-going projects are on a slow execution mode leading to tight cash cycle. Financial position of State Distribution Companies (State Discoms) is also a matter of concern.

Realty

Realty which experienced unprecedented growth in 2007, post the aftermath of the financial crisis tempered to moderate levels of growth. Demand shifted away from investors to actual end users. Most players are also saddled with huge debt.

The Final Word

It is evident that significant enhancement of portfolio returns can simply be achieved by being sector choosy and within sectors stock choosy. Embrace well performing sectors that are based on solid macroeconomic forces (like demography, consumption, exports, etc.) and avoid sector that suffers from macroeconomic tailwinds (like high interest rates, capital expenditure, regulatory pressures, etc.). While not ignoring good companies in bad sectors, avoid bad companies in good sectors as it may have company specific issues (corporate governance mostly) and may not be in a position to take advantage of favorable sector atmosphere.