This Article originally published in The Global Analyst

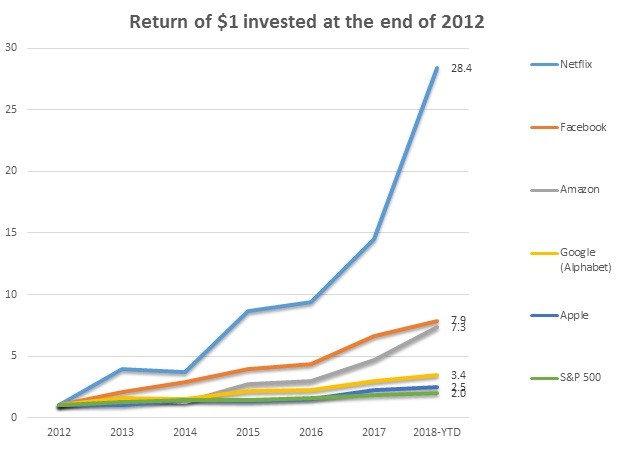

A $1 invested in Netflix in 2012 will be worth $28 now implying an annualized performance of 70%. Though not as impressive as Netflix, other FAANG stocks like Facebook, Amazon, Apple and Google have provided returns that beat the broader S&P 500.

What has gone up in the past will go up in the future and vice-versa. In simple form, this is what momentum is all about. However, a true technical definition found in a research paper authored by the famous Clifford Assness and his colleagues defines it as “the phenomenon that securities which have performed well relative to peers (winners) on average continue to outperform, and securities that have performed relatively poorly (losers) tend to continue to underperform”.

As we can see, it is the anti-thesis of efficient market hypothesis as it is predicated on irrational market behavior. While it may not confirm to standard finance theories, momentum concept has worked in the past especially for traders or investors with a short time span. However, we should not confuse it with trend following as taught in technical analysis course. While trend following looks at absolute price changes, momentum is a relative concept i.e., it looks at increases or decreases of a particular stock in relation to its peer group. This is where the story gets interesting. If you think about it, buying stocks consistently that has gone up relative to its peers and selling stocks that has gone down consistently relative to peers is akin to keeping your winners and shunning your losers. While many investors and fund managers may not call their strategy as momentum, they are exactly doing that to reap benefits. Momentum strategy is as much behavioral as it is technical as only that can explain the “herd mentality” of investors.

The key questions to ask are:

1. What tools to use to apply momentum? Or How to use one?

2. In what context can it work?

3. How to lace a portfolio strategy around it?

Of course, momentum is chart gazing and does not involve fundamental analysis. Some argue that it can at best be a screener and should be reinforced with fundamental research. That would be taking away the concept, though I see no reason why one should not do it. There are several tools available like MACD, RSI, Stochastic Oscillator, Candlesticks, etc (Did I say it is not technical analysis?). These tools will enable one to calculate the speed of change and act accordingly. Investors can define times to apply momentum factor. For eg., it can be defined as a day wherein one will buy stocks that has gone up during the day and sell stocks that has gone down, etc. The time frame can also be say past 1 year in which case the game changes from trading to investing.

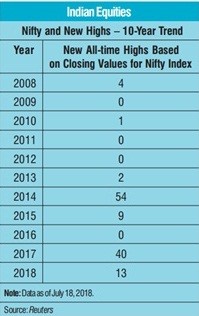

However, in order to buy with conviction stocks that have gone up recently one should also bet on low volatility. Because high volatility will cause frequent contra trades thereby increasing trading costs reducing strategy returns. Essentially, momentum works very well when volatility is either low or when periods of high volatility tends to be clustered together. If one observes carefully VIX, a great volatility indicator, it does go through long periods of low volatility providing immense opportunity for momentum investors. Since the pretext of momentum investing is based on irrationality, market inefficiency also acts as a good context. Most of the emerging markets qualify as inefficient markets, meaning where prices are not fully reflecting all the news and information about the stock. In the Indian context, the markets have exhibited several highs during the last 10 years as seen from the table. However, what is interesting to note is that they tend to cluster around and this is what provides the needed opening for momentum investors.

While momentum has proven to be a useful strategy, given its chart-based nature, there is a tendency to look down on this as a not so solid strategy that survives finance theory like factor based investing. In a recent research published by Research Affiliates, it was stated that “No U.S.-benchmarked mutual fund with “momentum” in its name has cumulatively outperformed its benchmark since inception, net of fees and expenses”, though it must be said that it was based on a relatively small set of samples.

From a portfolio strategy point of view, the following options emerge:

1. Create your own momentum portfolio by following the tools like RSI with a defined period (say 3 months or 1 year). This is a hands-on approach and may involve significant time and energy.

2. Invest in mutual funds or ETF’s that envelop momentum as a strategy. For e.g., one can focus on no load mutual funds with the best performance over the trailing 12 months.

3. An integrated portfolio approach where share of momentum based strategies will be in relation to levels of volatility. When volatility spikes, allocate less to momentum and vice versa.

When I googled for “famous momentum investors”, I could not get a neat list before me. This shows that the strategy still is not mainstream and clear-cut like say value or growth. It is worth noting that Newton, perhaps the smartest person to walk this planet, lost a fortune in the South Sea Bubble in the 1700s. His famous quote was that he, “could calculate the motions of the heavenly bodies, but not the madness of the people” (Larry Swedroe).

Happy Investing!