The Global Analyst

While Nifty 50 (a good proxy for large cap) gained 3.2% in 2018, Nifty Midcap 100 was down 15% while Nifty Small cap 100 was down 29%. The poor run for mid and small cap continues well into 2019 where they are down by 10% and 12% respectively. While this presents a scary picture, the long-term performance is not bad at all. A dollar invested in Nifty 50 in 2009 is now worth $3.6 (Feb 2019) while the same for Nifty Midcap 100 is now worth $4.3. While there is upside to be reaped in the long-term, year to year volatility can produce ulcers for lay investors.

All major multi baggers of today started their life as small cap once upon a time akin to a kid! Extraordinary returns in stock market is possible only if we can identify small caps or mid-caps that can go on to become large caps producing outsized returns. Sounds like a fairy tale, but fishing the mid and small cap pond can be treacherous. To understand why, just look at the distribution of stocks in the National Stock Exchange (NSE) as of Feb 2019.

Note: Large cap defined as greater than $5 billion, Mid cap between $5 b and $1 billion and Small cap less than $1 billion.

From a market capitalization point of view, large caps account for 67% but has only 4% of number of companies. On the other extreme, small caps account only for 10% of market cap but accounts for 86% of total number of companies. It is the twin factor of extremely large universe coupled with small size, that makes stock identification a difficult game within small caps.

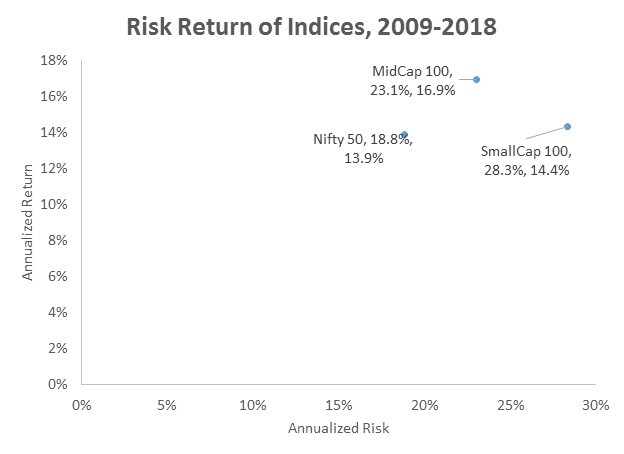

If one is not keen on stock picking, index investing can be an option especially through Exchange Traded Funds (ETF’s). However, a look at the performance during the last 10 years indicates several things. While there is clear risk premium observed between Nifty 50 and Midcap 100, there is no such premium observed with Small cap. In other words, the small cap index produced lower returns compared to mid cap but also took higher risk! Also ETF investing should also take into account the index rotation aspect. For eg., stock exchanges that maintains these indices frequently include and exclude companies from the index based on liquidity, profitability, and other criteria.

Please note the huge churn that Nifty Midcap100 experiences compared to Nifty 50.

While mid-caps can provide better risk-adjusted returns than large caps in the long-run, it is certainly not without risks. Chief among them would be the corporate governance angle, where most of the mid-caps and small caps, being owner driven can give corporate governance a goby in their quest to post profits, and grab market share. Also, given the low levels of institutional investments in mid-caps and small caps (especially by foreign investors), there may not be any real pressure towards better adoption of good corporate governance. Hence, stock picking purely based on published financial statements can be treacherous. A related issue to poor corporate governance is the lack of transparency. Many of the mid-caps and small caps may not have an active investor relations department that can provide investors with credible information about their companies future plans. Also, the research coverage tends to be sparse in this area leading to poor transparency. The mid-caps and small caps also experience heightened volatility compared to large caps (pl see the risk-return graph). High levels of volatility can cause sleepless nights to investors though it can present some good market timing opportunities for investment.

So, what should be the investment strategy? It depends if you are a professional investor or lay investor. For professional investors, the obvious road is stock picking backed by arduous research. Here I would suggest to fish in the midcap pond which is much smaller with 197 stocks compared to small cap pond that has 1,634 stocks. Also the risk adjusted performance of Midcap is better than small cap. The risk of poor corporate governance, transparency, and liquidity reduces as companies graduate from small cap to mid-cap. Hence, picking stocks from the mid cap pool can increase the winning odds tremendously. For the lay investor, the best bet would be ETF’s especially the Midcap 100 preferably through SIP route to avoid market timing issues.

In the final, I can say that while mid-caps and small caps are not for the faint hearted, it certainly is the way to multi baggers than the large caps which may suffer purely from its own weight!

Happy Investing!