This Article was originally published in The Global Analyst

It is this usual time of the year when we have to play the role of “astrologers”.

The Indian stock market returned 12% (in 2019). While this is an impressive performance compared to 2018 when the index registered only 5.9%, it is by no means a stellar performance. The key question is: Can we expect 2020 to be a “Stellar” year as that’s what every investor wants (probably every year!).

I would like to summarize my findings in terms of the following framework to take a call for 2020:

Let me elaborate my assessment a bit on each of the parameters.

Economy: It is now no secret that Indian economy is limping on many fronts. The main one is the tepid economic growth. Projections are pointing to a growth of 4 to 5% while India needs a growth of 7 to 8% to create the needed jobs and make India “Shine”. Raghuram Rajan calls this as “Growth recession”. India is also starring at the possibility of hitting a stagflation, a combination of poor growth and inflation. Our fiscal and current account balance is in the negative range. The fiscal balance is especially very worrisome having reached -8% which provides very little room for maneuvering. In fact the true fiscal deficit, if we take into account the states, is actually closer to 10%, a level where credit rating agencies will put India on negative watch list. While the government is boldly taking many measures (including the huge tax cut for corporate India), none of the measures are aimed at demand revival. Therefore, my take on the economy is “bad”.

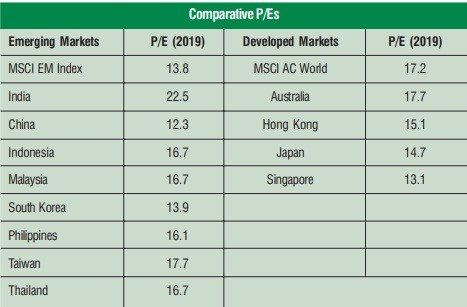

Valuation: It is said that every company is either good or bad based on the price at which it trades. The same applies to markets as well. The most common measure of valuation is the price to earnings and price to book ratios. India probably counts as one of the most expensive markets in the world. As can be seen from the data, India’s price to earnings ratio in the emerging market index is 22.5, while the same for the broader index is 13.8. Key markets referenced in the table has much lower p/e multiples compared to India. Foreign investors will definitely find it hard to invest in Indian stock market at these lofty valuation levels. The only way the p/e ratio can come closer to the emerging market index or to other countries is through earnings growth.

Earnings Growth: Here again the story is not that heartening. Though many sell-side broker reports point to 25% growth estimates in earnings for 2020, Reuters smart estimates point to a 1.2% growth for 2020 as against 6.7% in 2019. Though the corporate tax cut will help boost earnings, what we need is operating earnings growth which is not expected to happen unless demand revives. There are many stressed sectors including automobiles, banking, etc that will find the going tough. Hence it is a not a rosy picture on the earnings growth as well.

Business Confidence: This is a qualitative measure but a very important one though. Indian companies have not been spending on capex for many reasons, but mainly on the back of low business confidence. While the “fear” theory propagated by the Bajaj senior may be a bit farfetched, actual confidence among businessmen to commit on capex is indeed low signaling more time for earnings to play out. Strong political leadership along with good global prospects can bring the confidence back. Both are hanging as of now.

Global Market Sentiments: The US is experiencing one of the longest bull market scenarios. Economists are fearing a recession anytime and Fed has little room to move in terms of using interest rates as a policy tool. The EU is now inundated with negative rates. IMF has been revising global growth estimates downwards every time they come up with a new report. The probability of a recession and a bear market for US and Europe is rather high in 2020. If that happens, all emerging markets including India will face the heat.

Indian stock market has been doing reasonably well for now almost 8 years albeit for one year in between (2015) when it experienced a mild fall. I believe markets do have a cycle. While in the long-term, emerging markets like India will be upward trending, the cycle effect will make sure that a series of positive performance will be eventually followed by a negative performance.

Also most of the sectors and stocks score modestly on the Return on Equity metric while commanding lofty valuations (price to book or price to earnings). In the past, a good market performance will mean good sector performance across the board. However, post 2011 I notice that a good market performance can produce mixed bag when it comes to sectors. Hence taking a sector call is really difficult. While automobiles face weak freight demand, auto ancillaries face weak retail demand. While banks and non-banks face the prospect of non-performing assets, construction materials face the fiscal challenges of government and slowdown of the economy. Similarly capital goods sector will be affected by the prolonged phase of slowdown led by weak capex cycle.

Investment Strategy

The investment strategy will clearly depend on what type of investor you are:

Lay Investors: This category is mostly investors with non-financial background. The best strategy would be to invest at the market level through systematic investment plan to bet the market volatility. Funds or ETF’s could be the choice.

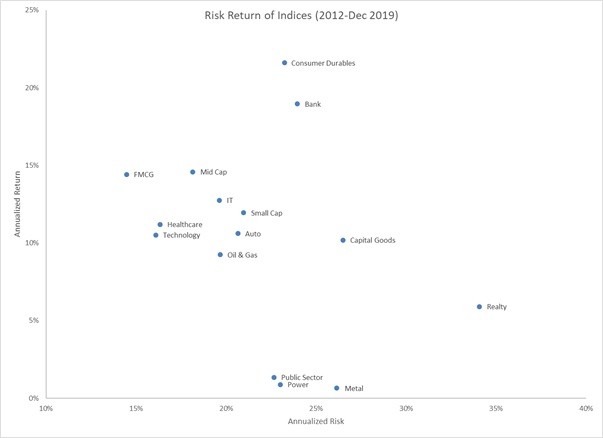

Professional Investors: This category is mostly investors with financial background and some familiarity with stock market investing. They may wait for opportune moment in markets to take advantage of valuation. Some select sector bets can also help. A careful look at the long-term performance of various sectors and sub asset classes may give some pointers in this direction. For eg., FMCG has the best risk-reward ratio for the long-term though they did not do that well in recent years. In the case of a severe downturn in the market, such sectors can provide a great opportunity for investment. On the other hand, Realty sector has the worst risk-reward ratio. Even though they have done reasonably well in 2019, investors may want to exercise caution for long-term investments. There are many sectors with poor risk-reward ratios like public sector, power, metal, etc.

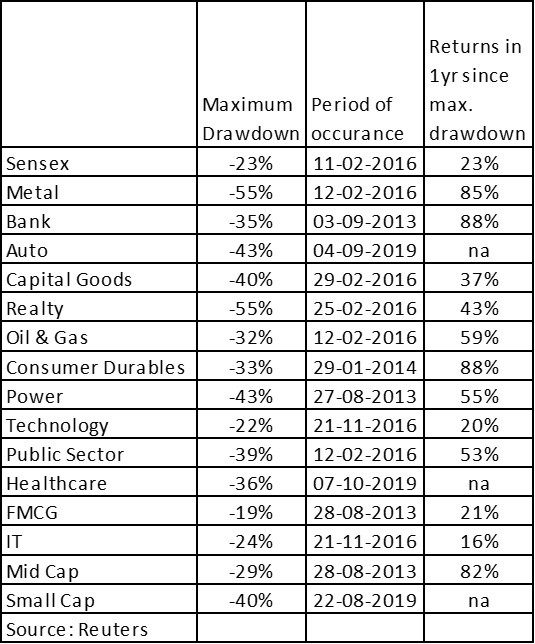

Also professional investors should watch the experience of the Indian stock market from a drawdown perspective. A drawdown is defined as the extent of fall from a high point to a low point. The broader market (Sensex) has experienced a maximum drawdown of 23% and within one year recovered 23% from the bottom. Hence, professional investors should take a market fall (drawdown) as a great opportunity to enter at attractive levels as the upside for such an investment strategy is really very good. In fact, they can go one step further and play the same strategy at a sector level. For eg., while Metals sector experienced a maximum drawdown of 55%, the recovery was 85%!

Happy Investing!