This Article was originally published in Market Express

I always wondered how effective it is to invest in an IPO. It is true that all major rock star companies today (the Nifty 50 biggies) were once an IPO making modest entry in the investment world. We have also heard many stories of block buster returns on IPO’s and how the investments have turned into multi bagger over time thanks to a series of bonus, rights, dividends, etc.

However, the IPO world is not easy to navigate as for every rock star there are many more fallen angels. While it is a challenge to evaluate the issue and take a decision to invest, it is also a game of “lottery” where probability plays a huge role in getting some results. While in very attractive issues, the probability of allotment reduces significantly, in not so attractive issues one will be saddled with a loss making investment proposition. In order to decide on what a good issue is one needs to look at valuation, recommendation by experts and extent of over subscription (indication of quality).

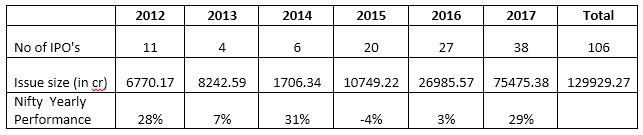

Indian capital market has been witnessing some good IPO interest of late. During the last six years (2012-2017), there were 106 issues raising nearly 130,000 crores (app $200 billion). However, 2016 and 17 clearly are watershed years in that it constituted 65 issues (out of 106) and accounted for 80% of total money raised in the 6 year period. While IPO’s tend to flock a bull market, a look at yearly stock market performance does not provide that correlation consistently. While we can clearly see a link between market performance and IPO activity in 2017, one cannot see the same in 2014 when Nifty increased by 31% but there were only 6 issues raising a measly Rs.1,700 crores.

Deconstructing the Performance:

There are three critical variables to look at while deconstructing the IPO payoff structure. The first will be valuation, the price point at which an issue is offered. While a higher price point is preferred for the issuer, it is vice-versa for the investor. Also higher valuation will imply lower interest in the issue. The second factor will be expert recommendation. Since these are new companies on which publicly available information is scant, investors generally look to expert recommendation/grading while deciding to apply. The third important factor is the extent of oversubscription. The more an issue is attractively priced and if the issue receives favorable recommendation from experts, the higher will be the extent of over subscription. However, higher over subscription also means lower probability of getting allotment.

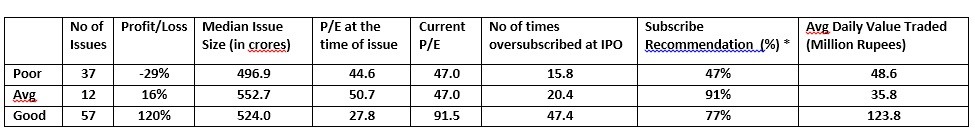

The 106 issues during the last six years provide an interesting set of data to analyze and decipher the value proposition and payoff structure of investing in Indian IPO’s. They were ranked based on their performance and classified as Good (price returns above 25%), Average (price returns between 10% to 25%) and Poor (price returns less than 10%).

It is heartening to note that most of the issues ranked good in our analysis by their subsequent performance post listing. There were 57 issues out of 106 that ranked good with an average appreciation of 120%. The main reason for their good performance is the attractive pricing implied by the price to earnings ratio at the time of issue. The good group’s p/e at the time of issue at 28 provided scope for p/e expansion as implied by its current p/e at nearly 91. Also, these IPO’s enjoyed very high levels of over subscription and enjoyed 77% “subscribe” rating from experts. Hence, all of the three factors i.e, attractive valuation, positive recommendation and high oversubscription lead to this group performing very well.

On the other hand, the poor group consisting of 37 companies fared worst and yielded a negative return of nearly 30% on average. They were priced expensive as implied by high p/e ratio at the time of issuance (45). They received very low level of “subscribe” recommendation from experts at only 47% resulting in very modest levels of over subscription (16).

The average group returned 16% on average, priced as expensively as the poor at a p/e ratio of 50 but enjoyed the highest “subscribe” recommendation (91%). However, because of high valuation the level of oversubscription was only marginally better than poor at 20.

It now becomes clear that when the issue is priced attractively, and enjoys “subscribe” recommendation from experts, it tends to experience very high levels of over subscription leading to its exemplary performance post listing. On the contrary, if the issue is priced steeply and enjoys lower levels of “subscribe” rating, it will result in lower levels of over subscription and may thus perform poorly post listing. Also, a quick examination of liquidity shows that good issues tend to trade more and enjoy higher levels of liquidity compared to average or poor.

How can we action this information?

While classifying the 106 issues into poor, average and good makes an interesting historical analysis, it can also be used for prospecting investing options. As a strategy, one can look at the list of IPO’s classified under poor/average and “mine” opportunities by zeroing on those companies that enjoyed subscribe rating, was highly oversubscribed and valuation at the time of issuance being very high. Such issues could now be available for valuation that is more modest and can thus be investment targets provided they continue to perform well at a business level. Therefore, the poor/average list is a great place to mine opportunities. However, the good list may be hard to mine given the significant jump in their valuation.

PS: The author thanks Subha Iyer for data assistance and research inputs.

Pl write to siyer@markaz.com for an excel file containing all the workings.