This Article was originally published in The Global Analyst

"There are many roads to Nirvana!”

When we talk about equity markets, we are always reminded of investment stars like Warren Buffet, Charlie Munger, Peter Lynch, Seth Klarman, George Soros, etc. Investment professionals and critics watch carefully how these legendary investors invest and sometimes try to replicate their styles albeit with only limited success. While we all know that equity investing is the best bet to beat inflation in the long-term, there are many ways to get there. The multitude of ways are what is generally described as investment styles. They are structured based on their characteristics and have been rigorously tested historically to generate risk adjusted returns. However, not all of them work very well under all circumstances.

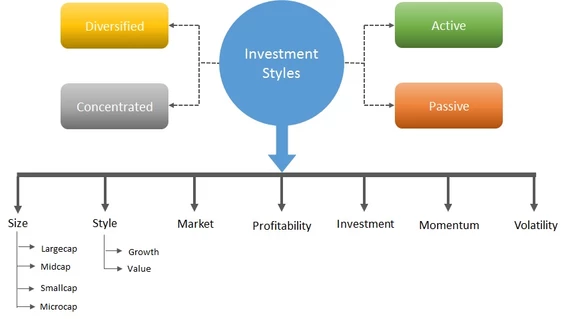

Investment styles are also broadly called factor investing. Celebrated noble laureates Eugene Fama and Kenneth French introduced factor investing to the investment world. In the initial days, life was simple and there was only one factor i.e, the market. The market factor was captured through a simple metric called “beta”. Beta measures the sensitivity of a particular stock to the broad market. A high beta implies more sensitivity and hence high risk and vice versa. From a one-factor model, Fama and French first expanded it to a 3 factor model that included market, size and style. Recently they expanded it to a 5 factor model with the addition of two more factors i.e., profitability and investment. Today, investment styles are multifarious and complicated. Some of the styles do well in a recession while others do well in expansion. Some of them can adapt themselves to the manager in question. For eg., momentum style will suit a hedge fund better than a middle level family business.

The following chart briefly captures the current architecture of investment styles.

Mostly institutional investors and high net worth clients follow these styles while retail investors go by the advice given by their investment advisors. The most prominent, popular and important style is based on size as measured by market capitalization. We can visualize four such categories, large cap, mid cap, small cap and micro-cap by dividing the universe based on their sizes. Usually quartile techniques are adopted to slice and dice them. As the name implies, large cap stocks are big companies, mostly market leaders in their respective industries. Many of them can be big family groups, multinationals and large public sector companies (navratnas). They enjoy high longevity and set the bar in terms of governance and transparency. Largely they are liquid making it easy for foreign investors to invest. On the other hand, mid cap and small cap companies are smaller, have limited market presence and share, and can represent ordinary entrepreneurs. They normally tend to be newbies, with sparse liquidity. Many of them rank low on governance and transparency. Due to this reason, foreign investors are choosy about taking positions in such companies. In other words, they represent higher risk compared to large cap companies. It is for this reason that they outperform large cap stocks in the long run as they demand more risk premium.

The next popular classification is based on style i.e., value and growth. Value stocks are stocks with low price to earnings ratio while growth stocks are stocks with high growth potential. In case of value stocks, low price is a key determining factor while in growth stocks future growth potential is important more than the price. Investors like Seth Klarman are value investors in that they buy good business at attractive prices. However, low price is not always indicative of future value. There is a reason why the market is pricing those stocks in the low range. Hence, it is a lot more hard work to weed good companies in the value space and hence research and knowledge plays a great role. However, since they are more risky bets than growth stocks value stocks outperform growth stocks over time.

We can also blend size and style and create combinations as below:

Investment style based on profitability is to delineate profitable companies over others (in what is termed as quality stocks). In other words, companies with high operating profit generally outperforms companies with low operating profits. This is relatively a new investment style that is proposed by Fama and French that is yet to be rigorously tested.

It is interesting to note a new style called investment. As per this, companies with high investment and asset growth will tend to underperform companies with low investment though this concept is not yet well tested. The belief is that companies that invests heavily take more risk than companies that invest less especially if their cost of capital is higher than the project IRR. Many times, CEO’s embark on huge investment plans just to keep them and their team busy.

The momentum style believes that stocks that go up in price will tend to go up more and vice versa as market generally is guided more by psychology than reasoning. Hence, it is a good idea to buy stocks whose prices are going up and sell short stocks whose prices are going down. Such strategies play very well in a hedge fund context that can employ technology to spot such companies through what are termed as high frequency trading.

Finally, volatility as a theme is also emerging to be an important investment style. Stocks with high volatility tend to underperform stocks with low volatility. However, the problem here is that there is not one method of calculating volatility. While standard deviation is generally regarded as a proven method to measure volatility, there are other measures to capture volatility. Again, this type of style lends itself to more sophisticated investors like hedge funds.

While these represents the broad styles, there are various ways to execute a particular style. At one level, one can have a concentrated portfolio of just 5 to 10 stocks while at the other extreme we can have a portfolio with hundreds of stocks (diversified). In addition, portfolio execution can also be active where the manager includes and excludes stock based on his findings or it can be passive where the manager just mimics an index, which does not require any research.

As one can see, there are more than one road to become a successful investor. Take your pick.

PS: This is the introductory part of the series “Investment Styles- Why it matters”. This will be followed by sequels explaining each investment style in more detail.