EQUITY INVESTMENT STYLES-CONCENTRATED PORTFOLIOS

This Article originally published in The Global Analyst

“Wide diversification is only required when investors do not understand what they are doing.” Warren Buffet

A classic debate among investors, especially institutional investors, is whether to diversify a portfolio and reduce the risk or to concentrate a portfolio and reap rewards. The investment world is still not settled on this issue and hence this article!

Investment 101 teaches us that portfolios should be well diversified in order to reduce the risk and sleep well at night. While no one can argue on the merits of this argument, the issue is what constitutes a well-diversified portfolio? Benjamin Graham, the father of investing thinks that it is between 10 and 30 stocks; Seth Klarman, the celebrated value investor, thinks that it is between 10 and 15 stocks; Warren Buffet, one of the riches person on earth, thinks that it should be 5 to 10 stocks while John Maynard Keynes, the economic guru, thinks that is should be 2 to 3 stocks! In short, there is no consensus on what constitutes a well-diversified portfolio. Peter Lynch, a very successful fund manager for Fidelity, had at one point more than 1,000 stocks in his portfolio.

While pundits debate to settle this issue, let us see why a concentrated portfolio is a better idea than a well-diversified portfolio.

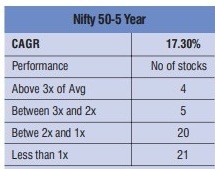

1. Good ideas are scarce: While an index may have 50, 500 or even 2,000 stocks, only few stocks perform way above the market average. For e.g., the table provides the performance of Nifty 50 during the last five years where the index averaged an annualized return of 17.3%. However, if we see the number of stocks that significantly outperformed the average market, they are not many. For instance, only 4 stocks performed more than 3 times better than the market while 5 stocks performed between 3 and 2 times the market. The rest meandered along. A concentrated portfolio will focus on the first two and would ignore the last two items in the table.

Source: Reuters for period ending 28th August 2018

2. Easy to track and research: If you have a 10 or 20 stock portfolio, it is humanly possible to keep a close tab on all of them. However, if one is managing a 100 or 200 stock portfolio, attention will at best be paid to 10 or 20 ideas, while the rest will be looked at in a passing manner. In other words, an overly diversified portfolio will mean spreading yourself thin.

3. Risk reduction still happens: A familiar argument to diversify a portfolio is to reduce the risk. However, it is now well demonstrated that significant risk reduction kicks in even when the number of stocks are as low as 10. Studies also show that beyond 30 stocks, the extent of risk reduction tapers so much that is hardly noticeable.

4. Moves the needle: A highly diversified portfolio means that one will have several stocks with very low weights. Even if these low weight stocks double or tripe in value, the impact at the portfolio level will be minimal given their low weights. A better idea would be to spend quality time in identifying few good ideas, invest a good sum in them and reap the rewards for the hard work.

5. Leverages on skill than luck: Concentrated portfolios will be highly dependent on one’s ability to identify a good investment opportunity. Compensating one for such a skill, either in terms of fees or through portfolio performance is worth at the end of the day. Alternatively, if one is managing an overly diversified portfolio, portfolio performance will be more of a luck game than a skill game. Why pay for luck?

However, concentration does have risks to contend with:

1. The “All eggs in..” syndrome: Concentration certainly increases the risk especially when most of the ideas sourced turn sour. Technical ability to identify good ideas is paramount and comes through formal training, business experience and long periods of observation. Executives in this fast-paced world will be tempted to throw some of these traits out of the window in search of quick success. In the process, they may put all eggs in one basket and the rest will be history.

2. Not suitable for retail investors: Retail investors, especially the non-financial variety, cannot pursue this path, as their risk tolerance can be very low. Hence, they are most often advised to embrace the mutual funds route where the funds are extremely well diversified.

3. High tracking error: Concentration certainly leads to significant departure from benchmark weights and this increases the tracking error for managers. Fund managers who manage funds for a living will not want to risk their career through high tracking error.

4. Asset allocation issues: The focus has shifted to asset allocation funds rather than stock or bond funds. Implementing an agreed asset allocation is best achieved through ETF’s or passive funds as they reduce cost and focusses one’s energy more on asset allocation. Fitting a concentrated portfolio in this asset allocation game can be tricky.

If you are a professional investor (both individual and institutional) and would like to significantly outperform the market in the long term, then concentrated portfolios is the way to go. However, be conscious of risks and manage them well.

Happy investing!