This Article was originally published in The Global Analyst

“Investing in a NBFC is like playing European roulette. Investing in NBFC’s is like playing Snakes & Ladders. There is that super long snake in the penultimate cell who brings you back to zero” Saurabh Mukherjea, Marcellus Investment Managers

There are 36 banks and 19 NBFC’s that are listed in Indian stock exchange. Both of these important sectors have been embroiled in some controversy or other recently. While non-performing assets has always been a burning issue with banks, the recent case of ICICI Bank and Punjab National Bank are not good advertisements to the sector. Even NBFC’s are in the thick of it through controversies surrounding lending against shares, etc. Amidst this negative publicity, the financial services segment is a key one for future opportunities. The debate is: where should you bet your shirt on? Banks or Non-Banks. Not an easy question, but definitely an interesting one from an investment perspective.

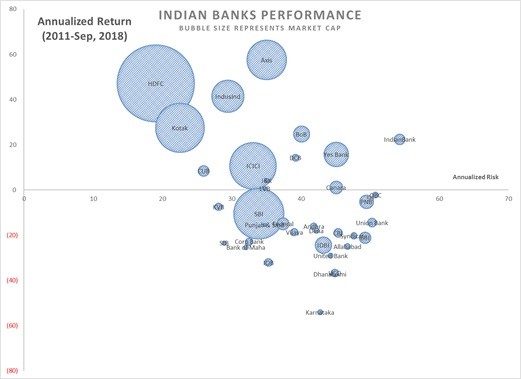

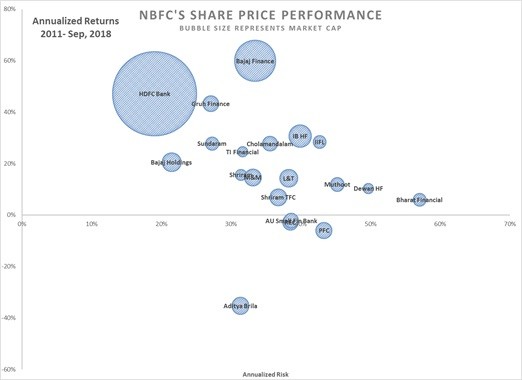

As a group, banks are certainly larger than NBFC’s whichever way you look at it. However, on performance metrics (Return on Equity and Return on Assets), NBFC’s have a clear edge over banks. This is also reflected in share price performance of banks and NBFC’s. Banks, as a group, provided an annualized return of 21% during the last 5 years while NBFC’s have provided a whopping annualized return of 46%. Looking a bit closer at the share price performance chart of Indian banks, it is clear that bigger private banks like HDFC Bank, Axis, Kotak and Indusind have generated appreciable long-term returns for shareholders. However, the chart is also plotted with several mid sized and small sized public and private sector banks delivering sub-par/negative returns to shareholders since 2011. This has caused the overall sector performance metrics to be lower. A similar look at NBFC’s tell a very different picture. Unlike banks, most of the NBFC’s have managed to create good shareholder value on the back of strong performance metrics. For eg., the Return on Equity for NBFC’s at 9.2% is nearly twice that of banks. The same goes for Return on Assets. However, excepting Bajaj Finance, none of them enjoy size and are very small, especially if we look at the median market capitalization.

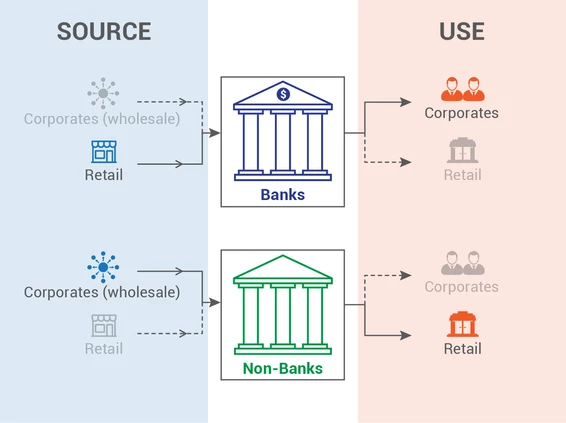

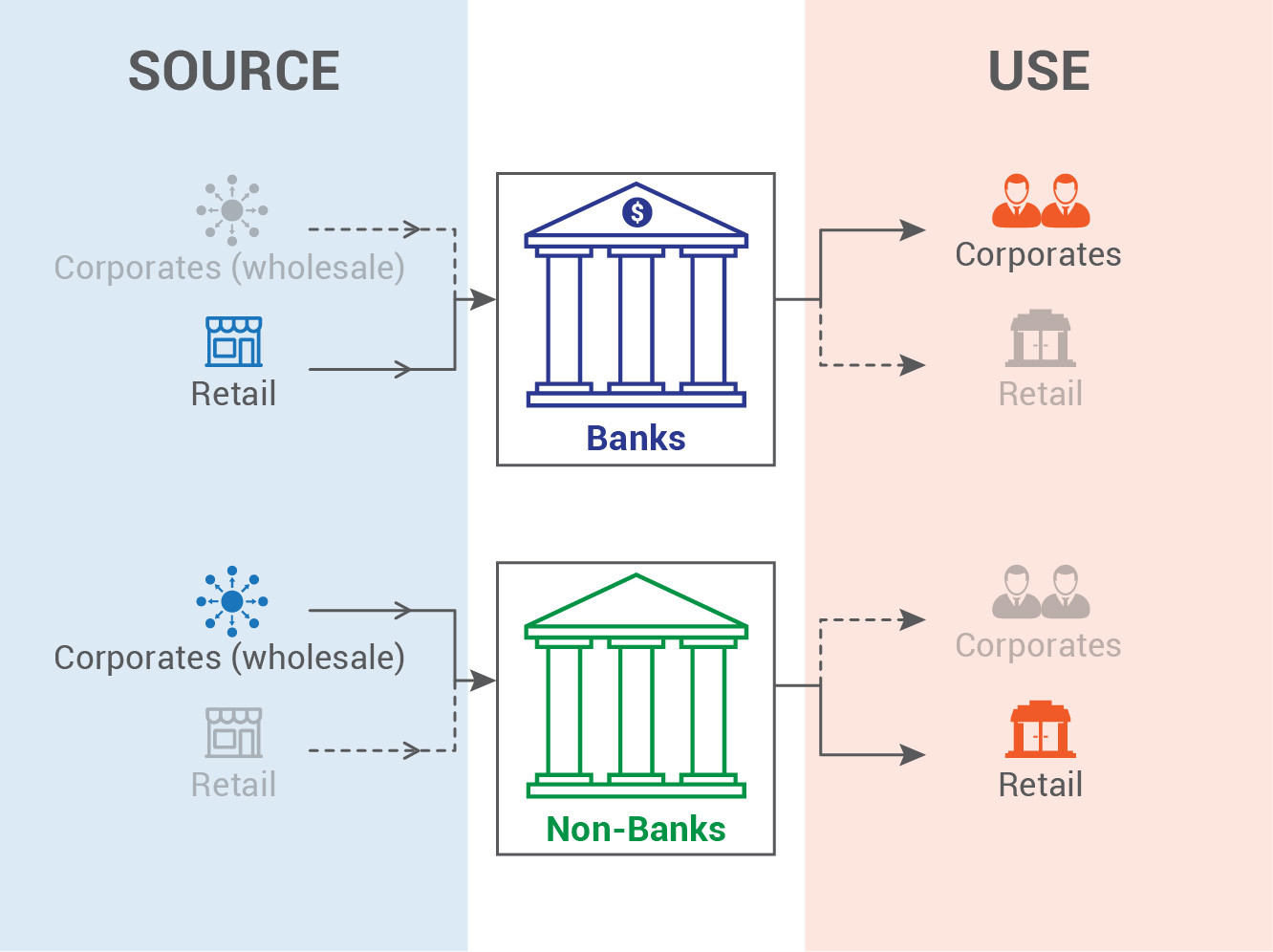

Let us now see as to what differentiates the business model for banks and NBFC’s. Both of them are in the business of financial intermediation in that they obtain their funding and deploy them with a margin. The segregation of corporates and retail applies on both sides ie.,sources and deployment. Here is where there is a key difference that is emerging. While banks depend to a great extent on retail sources of funding through deposits, NBFC’s depend on wholesale sources. However, when it comes to deployment banks predominantly lend to corporates while NBFC’s focus on retail. At the heart of this diversity lies the asset liability mismatch leading to non-performing loans, scams and scandals. The one with lower amount of NPA’s, scams, and scandals will emerge the winner.

NPA’s have been building up in the banking sector for quite some time thanks to this structure of obtaining funds through retail and lending them to wholesale. In such a case, high profile defaults (remember Vijay Mallya, Nirav Modi, etc ) will inflict greater pain to the whole sector with loss of money followed by loss of confidence. On the other hand, NBFC’s are somewhat in a safer territory since their lending is mainly to retail (consumer loan, mortgage, gold loan, etc) whose non-performing assets can be controlled. An out of context example in the form of micro finance will be adept here. Micro finance companies mostly lend to rural women with a 95% recovery rate! Retail customers are certainly low risk compared to corporate bigwigs, especially when they enjoy political clout! The retail focus of NBFC’s need them to build on franchise value more than banks. This is not to say that banks need not have franchise value. It is more at play for NBFC’s than banks.

A key factor that can explain the performance differentials of banks vs NBFC’s could be the presence and dominance of public sector in the banking space. Nearly half of the listed banks are from the public sector domain though they constitute only 25% of the market cap. However, the fact is that presence of public sector will inhibit nimbleness and can cause governance issues leading to NPA’s. I think governance can be an issue even with private sector banks when they become too big in size.

At a broader level, banks as a group performed less compared to NBFC’s. Hence, the verdict is clear. However, there are sharp differences in underlying performance of constituent companies. Banks like HDFC Bank, Axis, Indusind and Kotak have produced outsized shareholder wealth compared to other small and medium sized banks. The same holds true for NBFC’s where the performance of Bajaj Finance has almost dwarfed most other rivals in the game. In hindsight, it looks like the names captioned above would form good candidates for portfolio inclusion. However, if one can afford a bit more closer look and research on the universe of NBFC’s and idenfify those companies with good governance principles, solid franchise, risk management and sound business model. When looked at from this prism, NBFC’s have a clear edge over banks going forward.

Happy Investing!